To calculate deadweight loss you ll need to know the change in price and the change in quantity of a product or service.

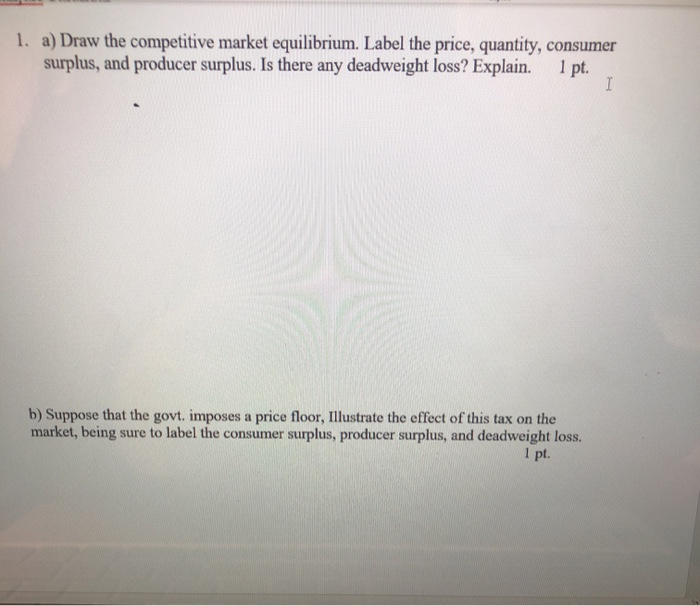

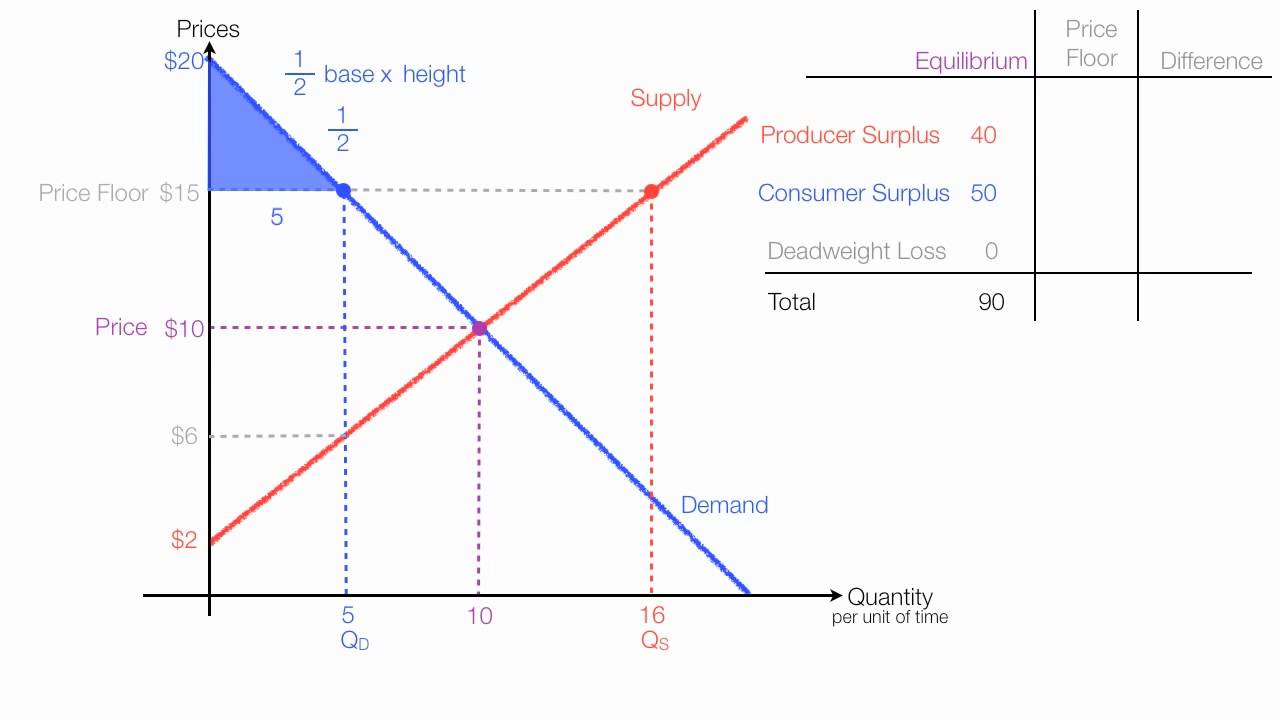

How to calculate deadweight loss price floor.

Let s go back to the example of jane and her café.

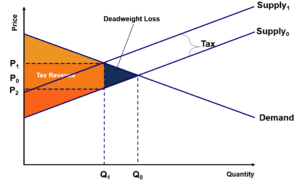

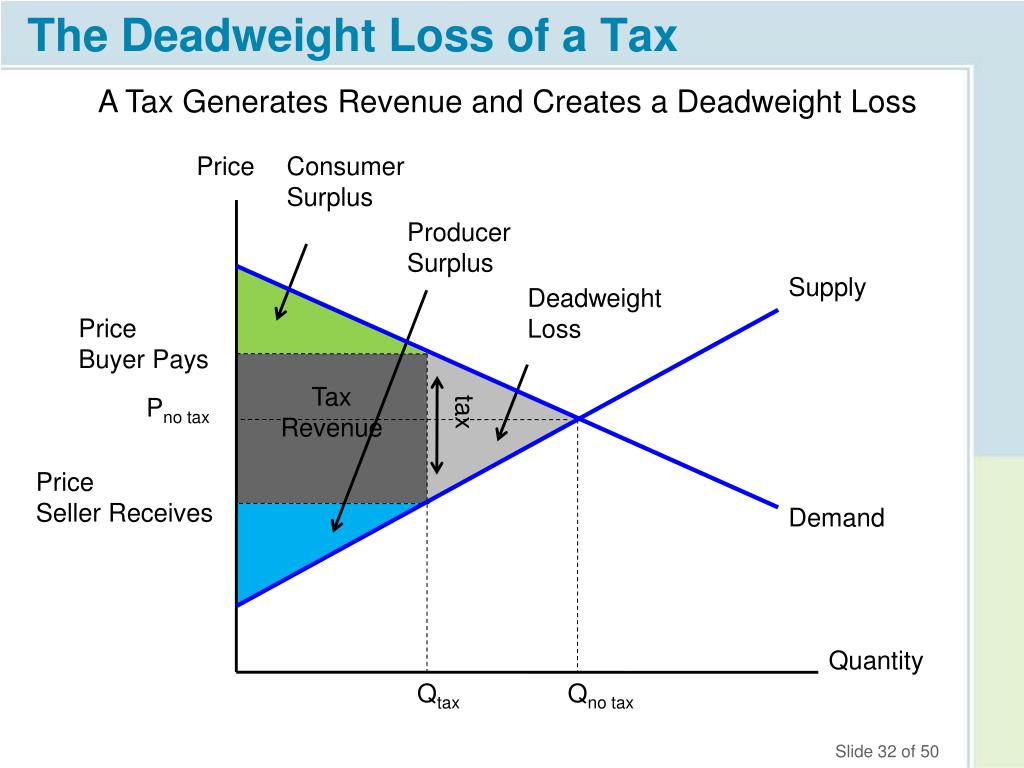

Imagine the federal government has introduced a new tax of one dollar for every pound of coffee she sells.

Deadweight loss 5.

The government sets a limit on how high a price can be charged for a good or service.

Causes of deadweight loss.

Relevance and use of deadweight loss formula.

The difference between supply and demand curve with the tax imposed at q1 is 2.

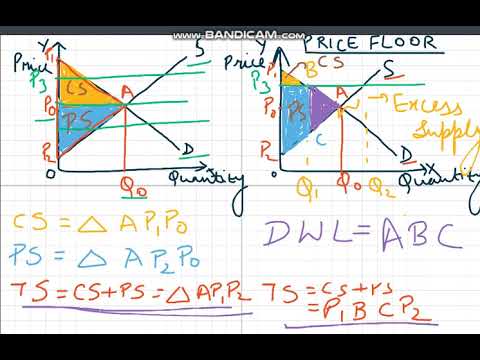

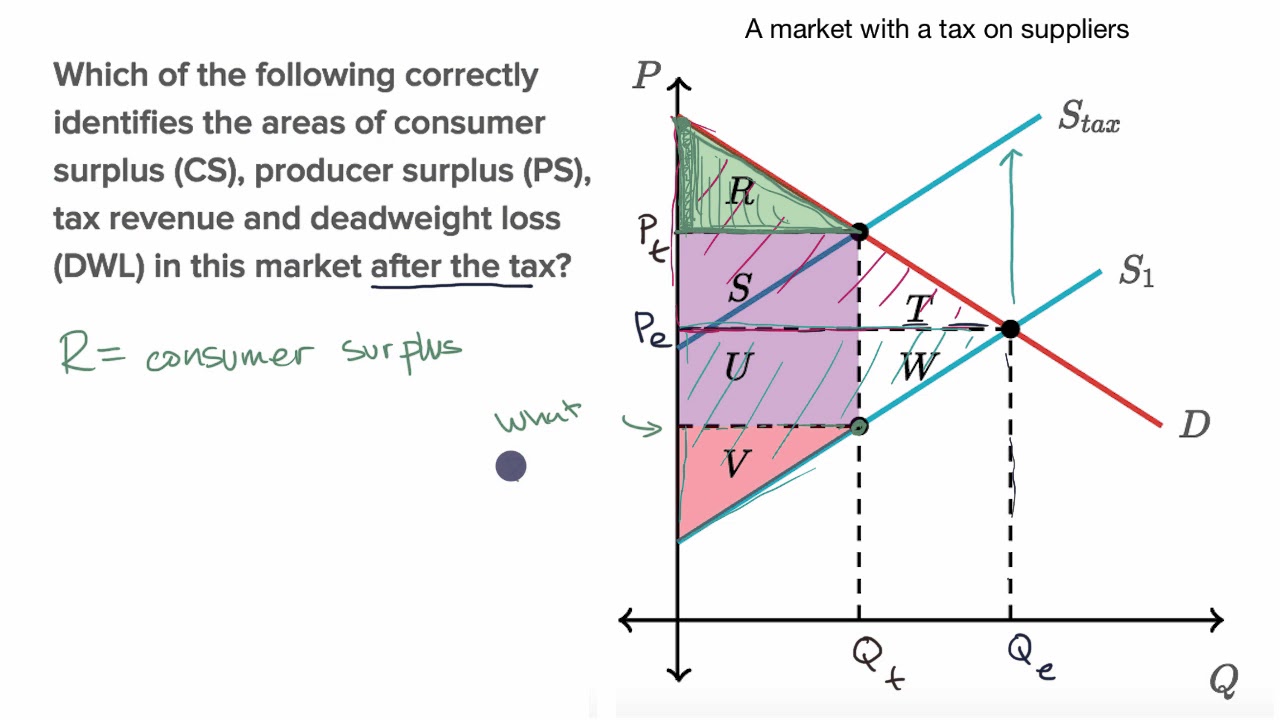

The deadweight welfare loss is the loss of consumer and producer surplus.

Deadweight loss pn po qo qn 2.

Deadweight loss dwl p n p o q o q n 2.

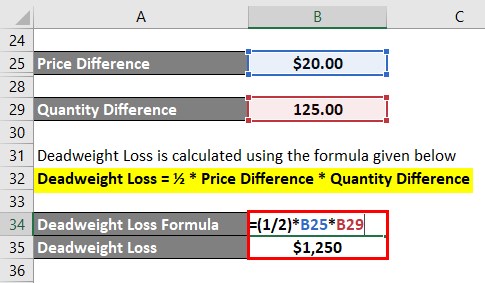

Calculation of deadweight loss can be done as follows.

A deadweight welfare loss occurs whenever there is a difference between the price the marginal demander is willing to pay and the equilibrium price.

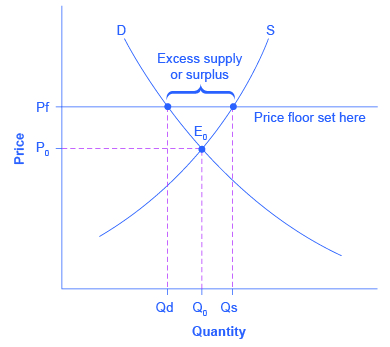

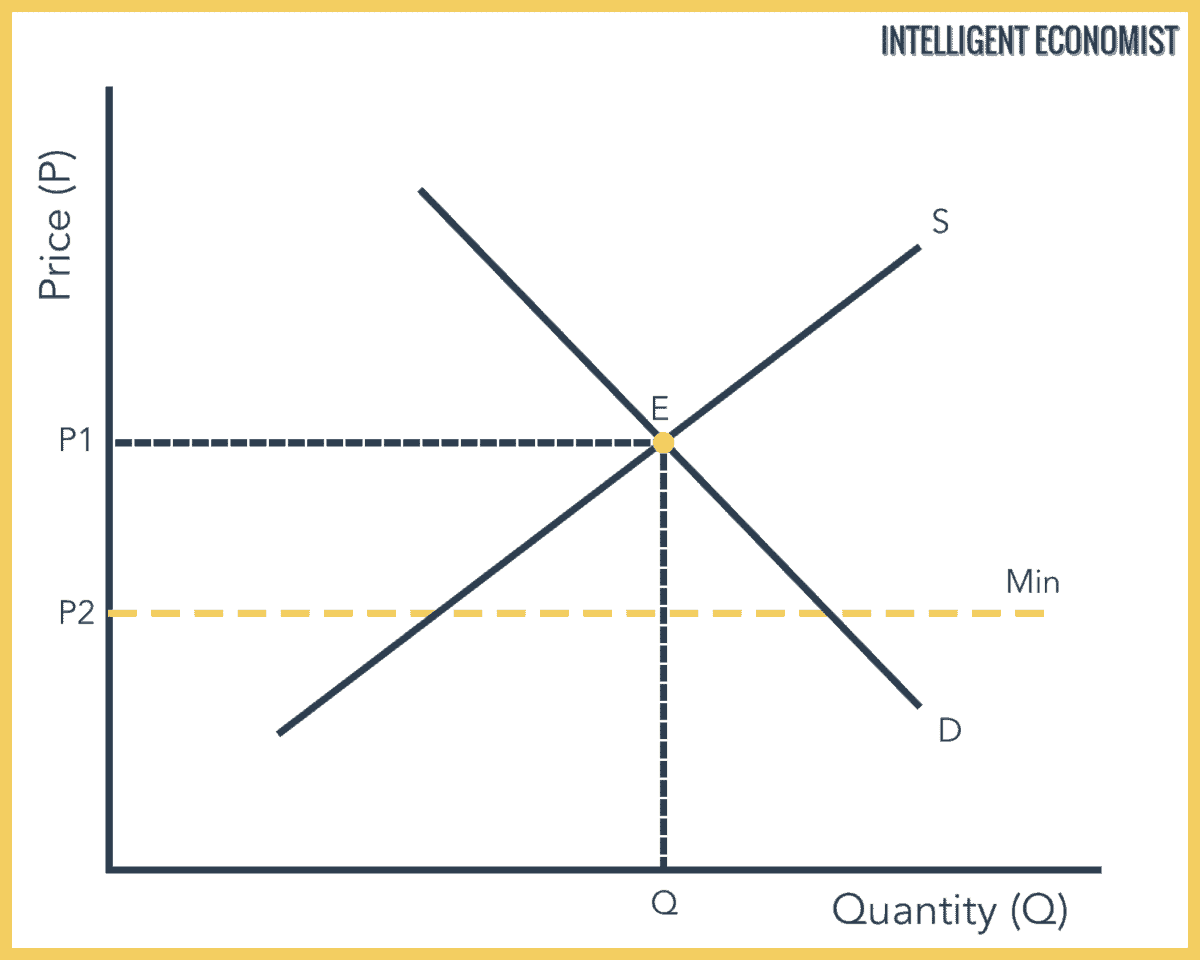

The government sets a limit on how low a price can be charged for a good or service.

Pn the product s new price after taxes price ceiling and or price floor is accounted for.

So the base of our deadweight loss triangle will be 1.

The new quantities of the product requested once taxes price ceiling and or price floor is introduced q n deadweight loss can be determined by the following formula.

Po the product s original price.

The new quantity demanded of the product after the price ceiling price floor or tax is imposed.

Price floors cause a deadweight welfare loss.

Use the following formula.

So our equation for deadweight loss will be 1 2 or 1.

The concept of deadweight loss is important from an economic point of view as it helps is the assessment of the welfare of society.

The formula to determine deadweight loss is as follows.

Deadweight loss price difference quantity difference.

We will call this q2.

Deadweight loss ig hf.

An example of a price floor would be minimum wage.

So here when we calculate deadweight loss for this example we get a deadweight loss equal to 1.