Even if a company pays tax using 115 jb provisions then also for calculating deffered tax liability asset the tax rate is regular income tax rate at present 30 but not tax rate u s 115 jb of income tax act.

How to calculate tax as per mat.

No marginal relief since the income does not exceed 1 crore.

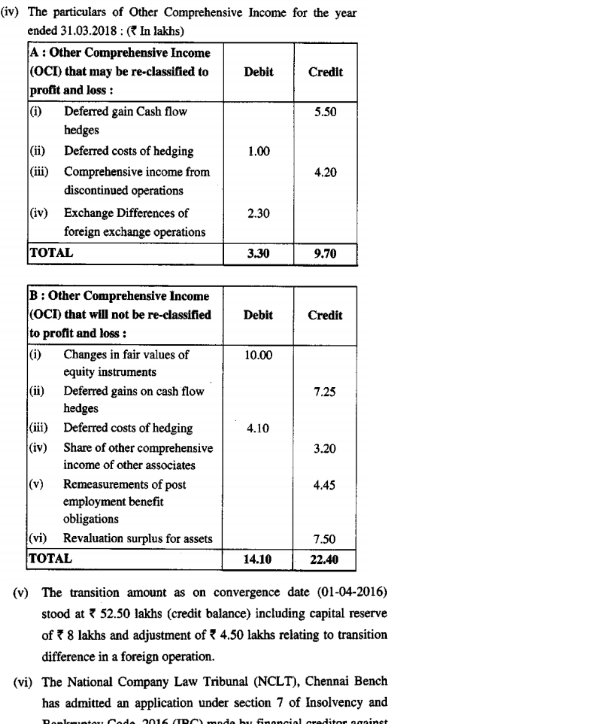

Tax liability as per the mat provisions are given in sec 115jb 18 5 of book profits plus 4 education cess plus a surcharge if applicable.

Mat is levied at the rate of 18 5 of the book profits.

Mat is applied when the taxable income calculated as per the normal provisions in the it act is found to be less than 18 5 of the book profits.

Tax 400 000 times 6 tax 400 000 times 0 06 24 000 dollars the cost with tax is 400 000 24 000 424 000 dollars.

The taxable income of abc company not availing any tax exemptions incentives as per the provisions of the income tax act 1961 is rs.

18 50 000 higher of the two mat credit.

Tax payable 30 plus edu cess of 4 31 20 of 50 00 000 15 60 000.

Mat is calculated as 15 of the book profit of the tax assesse.

Now compute tax payable as per mat provisions.

Mat rate has been progressively increased from 7 5 in 2000 to 18 5 in 2015.

Tax liability as per mat.

Minimum alternate tax calculation example.

Mat is equal to 18 5 15 from ay 2020 21 of book profits plus surcharge and cess as applicable.

First find the price after the discount.

Later on it was withdrawn by the finance act 1990 and reintroduced by finance act 1996 with effect from 01st april 1997.

Tax payable 18 5 surcharge 7 19 795 of 1 01 00 000 19 99 295.

How much is tax.

As per section 115jb every taxpayer being a company is liable to pay mat if the income tax including surcharge and cess payable on the total income computed as per the provisions of the income tax act in respect of any year is less than 18 50 of its book profit surcharge sc health education cess.

First of all calculate tax as per normal provisions of income tax.

How to calculate mat.

The list price of a scientific calculator is 100 dollars if you get a price discount of 15 and pay 5 for tax what is the actual cost of your calculator.

18 5 the mat rate has been reduced to 15 from fy 19 20 on rs.

The tax rate is 15 with effect from ay 2020 21 fy 2019 20 2.

Under existing rules book profit is calculated as per section 115jb of the income tax act 1961.

How is mat calculated.

Mat was introduced by the finance act 1987 with effect from assessment year 1998 99.

As per asi 6 for measurement of deffered tax asset liability the current tax is alwaysregular income tax rate.